Exness Payment Methods

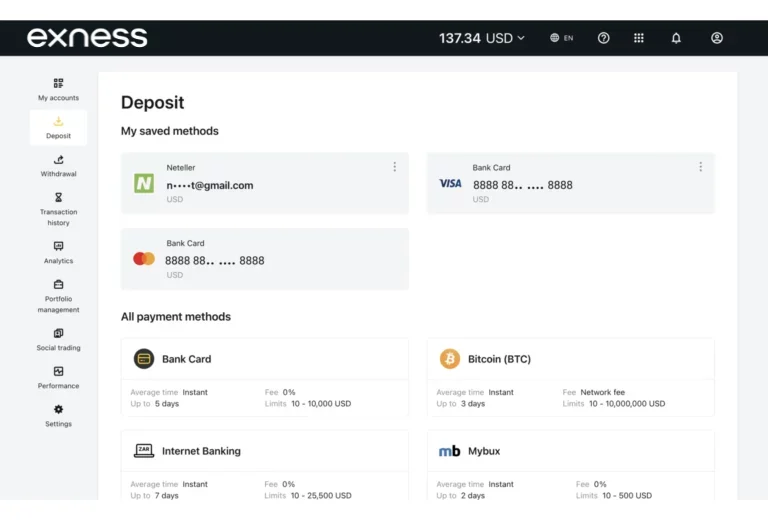

All available payment methods can be found in your Exness account under the “Deposit” or “Withdrawal” sections. To choose the most suitable method, log into your Exness account and navigate to the relevant tab, located on the left-hand vertical panel.

Once inside, you’ll see the payment options, the available transaction limits, and the processing times. To complete a transaction, simply select your preferred payment method and follow the step-by-step instructions provided.

After completing a transaction, you can save the payment method for future deposits and withdrawals. If your preferred method is unavailable, other options include:

- Bank transfers

- Debit or credit cards

- International payment systems like WebMoney

- E-wallets like Neteller and Skrill

As an Exness customer, you have access to both local and international payment methods for depositing funds and withdrawing profits. Keep in mind that some payment methods are region-specific and may not be available in all areas.

Regional Payment Methods

Local payment methods are available only for accounts registered in specific countries. You cannot change your registered country yourself, but you can modify other profile settings. If you move to a new region and want to use payment methods available there, you’ll need to register a new Exness account.

Debit and credit cards are typically considered local methods. For trading accounts, internationally accepted bank cards can be used, but ensure the issuing bank aligns with the region specified during account registration. All card transactions must follow specific rules, such as submitting forms for refunds when needed.

Global Payment Methods

Global payment methods are generally available for all trading accounts, but you’ll still need to verify your Exness account. Once your account is verified, you become a fully authorized Exness client, enjoying benefits like higher limits and hassle-free international transfers.

Global methods include electronic payment systems that are not tied to geographic location. Exness offers popular digital wallets like Skrill and Neteller. These methods are known for fast transactions and high security. However, always remember to log into your account to ensure secure access to your trading funds.

Base Currencies in Exness

As an international broker, Exness supports multiple currencies, allowing clients to trade in financial markets using various currencies. Both commonly used and less common currencies are available for trading accounts.

Some of the major base currencies supported for Standard Accounts include:

- AED (United Arab Emirates Dirham)

- ARS (Argentine Peso), PHP (Philippine Peso), MXN (Mexican Peso)

- AZN (Azerbaijan Manat)

- BHD (Bahraini Dinar), KWD (Kuwaiti Dinar), JOD (Jordanian Dinar)

- CHF (Swiss Franc), CNY (Chinese Yuan), EGP (Egyptian Pound), GHS (Ghanaian Cedi)

- INR (Indian Rupee), IDR (Indonesian Rupiah), PKR (Pakistani Rupee)

- JPY (Japanese Yen), KRW (South Korean Won)

- KES (Kenyan Shilling), UGX (Ugandan Shilling)

- KZT (Kazakhstani Tenge), MAD (Moroccan Dirham), MYR (Malaysian Ringgit)

- NGN (Nigerian Naira), OMR (Omani Rial), QAR (Qatari Rial), SAR (Saudi Riyal)

- ZAR (South African Rand), UZS (Uzbekistani Som), XOF (West African Franc)

- AUD (Australian Dollar), CAD (Canadian Dollar), USD (US Dollar), EUR (Euro), GBP (British Pound), and many more.

When creating a trading account, you’ll choose a base currency from the available options, which cannot be changed later. If you want to trade in multiple currencies, you’ll need to open separate trading accounts for each currency. In one personal area, you can have multiple active trading accounts.

Depositing Funds in Exness

Depositing funds into your Exness account is simple and straightforward. Follow these steps:

- Log in to your Exness account via the official website or the Exness mobile app.

- Once logged in, navigate to your Personal Area.

- Click on the “Deposit” button located on the sidebar menu.

- You will see a list of supported payment methods, including e-wallets, debit/credit cards, and bank transfers. Choose your preferred method based on factors like transaction speed, limits, currency, and fees.

- Select your base currency, keeping in mind that this cannot be changed later. Enter the amount you wish to deposit and provide your trading account number.

- Confirm the payment, following the specific steps for the chosen payment method. Instructions will appear on your screen to guide you through the process.

Once the transaction is complete, the deposited amount will be reflected in your trading account, and you can start trading with the aim of generating profits.

Minimum Deposit in Exness

The minimum deposit for Exness varies depending on the payment method and account type. For Standard Accounts, the minimum deposit can be as low as $1, making it popular among both beginners and experienced traders who prefer to trade with minimal risk. Even a small deposit can be enough to secure profitable trades and acquire valuable assets that can generate significant returns over time.

For Professional Accounts, experienced traders managing larger sums and higher trade volumes must deposit at least $200. While the deposit requirement is higher, the potential returns are also substantial. Professional accounts offer advanced features, tighter spreads, and instant execution, making them ideal for traders aiming for higher profitability.

Deposit Limits and Fees

Exness does not charge any internal commissions for deposits. However, if currency conversion is required, additional fees may be charged by third-party payment processors. For example, if you deposit $500 USD and your account’s base currency is USD, you will receive the full amount with no commission.

Deposit limits vary based on account type and payment method:

- Debit/Credit Cards: Minimum deposit is $10 per transaction.

- E-Wallets: Minimum deposit is $10.

- Electronic Payment Systems: No minimum deposit ($0).

- Bank Transfers: Minimum deposit is $3 (additional third-party fees for currency conversion may apply).

Common Issues and Solutions for Exness Deposits

Most users experience smooth and fast deposit transactions without any unnecessary steps. However, external factors can occasionally cause issues. Below are common problems and solutions:

- Technical Issues. If a deposit error occurs due to a technical issue on their end, contact Exness customer support. They are responsive and provide creative solutions to any questions. Support is available 24/7.

- Incorrect Information. If you’ve entered incorrect details, double-check for any mistakes. If no errors are found but you still can’t make a deposit, reach out to customer support.

- Regional Payment Restrictions. Log in to your account and verify that the payment method is supported in your region. If not, consider using an alternative payment method.

- Delayed Processing Time. If your deposit takes longer than expected and doesn’t appear in your account balance, ensure you’ve provided the necessary documents for payment verification. Lack of identity verification can cause deposit issues.

- Payment Method Declined. This usually happens when an unregistered payment method is used. Always use the payment method you registered with your Exness account.

For any unclear issues, contact customer support, where they will guide you and help resolve the problem efficiently.

Deposit Bonuses at Exness

Due to Exness’ policies, deposit bonuses are not offered to clients. However, traders still have opportunities to earn additional income through the Exness affiliate program. By joining, you can generate profits from interactions with the brokerage, with potential earnings from deposits reaching up to $2,000 USD in some cases.

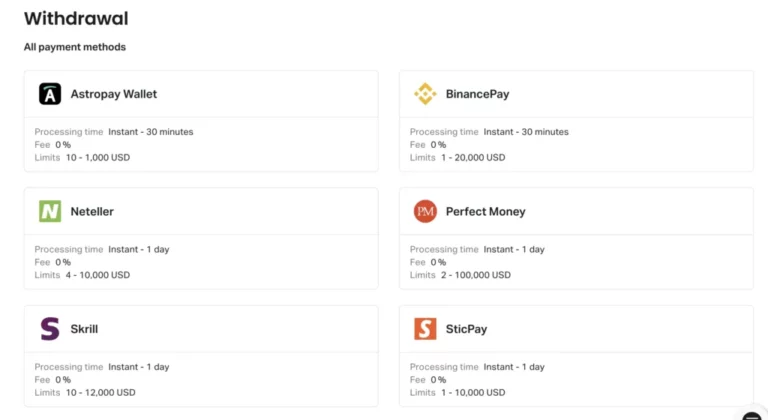

Withdrawing Funds from Exness

In trading, financial transactions, especially withdrawals from successful trades, are crucial. With Exness, you can access your trading account and withdraw funds anytime using the same payment method you used for deposits:

- Debit/Credit Cards: Withdrawal limits may apply depending on your provider, and banks may charge transaction fees.

- E-wallets: Withdrawals are instant and commission-free using e-wallets.

- Bank Transfers: To withdraw funds, submit a request to Exness with your bank details. Exness does not charge transaction fees, but your bank may. Processing time typically ranges from one to three business days.

Withdrawal Process:

- Log in to your account and go to the “Personal Area.”

- In the sidebar menu, select “Withdraw.”

- Choose your preferred payment method.

- Enter the required information, such as access credentials and the amount, then select the currency.

- Authorize access to the payment account and complete the withdrawal.

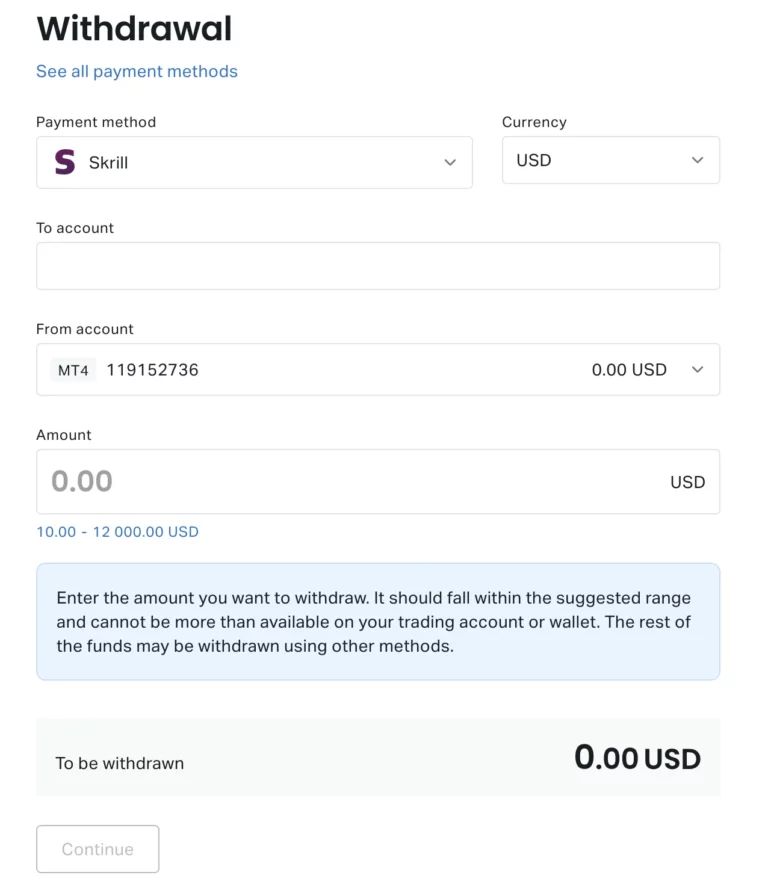

Withdrawing via Skrill on Exness

To withdraw funds using Skrill, follow these steps:

- Go to the “Withdraw” tab in your Exness account.

- Select Skrill by clicking on the relevant payment provider button.

- Enter the email address linked to your Skrill account and the amount you wish to withdraw.

- Confirm the payment, and the funds will be credited to your Skrill account instantly without any additional fees.

This method is reliable and convenient, with no commissions charged by Exness. Withdrawal requests are processed immediately, but note that only verified accounts can use Skrill for withdrawals on Exness.

Withdrawal Times

The processing time depends on the payment method:

- Bank transfers: 1 to 7 business days

- Bank cards: Up to 24 hours

- E-wallets (Skrill): Instant (with possible delays of up to 1 day)

Limits and Fees for Exness Withdrawals

Exness does not charge fees for withdrawals, but payment providers may apply their own fees. The broker offers reasonable minimum withdrawal limits that cater to both beginners and experienced traders. Limits range from $1 to $50, depending on the payment method.

Common Withdrawal Issues and Solutions

While the withdrawal process is streamlined, issues can occasionally arise. It’s important to familiarize yourself with the most common problems and solutions to ensure a smooth withdrawal experience.

- Incorrect or Outdated Information. Before withdrawing funds, always review your payment details to ensure accuracy. Providing the correct and updated information is essential for a smooth withdrawal process.

- Mismatched Deposit and Withdrawal Methods. It’s recommended to use the same payment method for both deposits and withdrawals to avoid issues.

- Technical Issues. For technical problems affecting withdrawals, it’s best to contact Exness customer support for assistance.

- Withdrawal Limits Due to Unverified Accounts. If you face withdrawal limits, it may be because your account hasn’t been fully verified. To avoid delays, complete the verification process by submitting all the required documents.

Security Measures for Financial Transactions at Exness

Exness understands the inherent risks in financial operations and, as a reputable international broker, has implemented advanced multi-layered security measures to protect customer accounts and personal information:

- Innovative Account Security: Exness uses private key encryption and two-factor authentication (2FA) to ensure top-level account protection. This prevents unauthorized access to your account.

- Segregated Trading Accounts: Client funds are kept in separate accounts from the broker’s, safeguarding your money and ensuring the security of financial transactions.

- Comprehensive KYC Process: Exness implements a thorough “Know Your Customer” (KYC) process to prevent fraud and illegal activities. This involves verifying personal information and identity documents before account approval.

- Fraud Detection Systems: Exness employs real-time monitoring and verification systems to protect customer accounts and online payments from fraud, ensuring suspicious activity is quickly detected and prevented.

- Compliance and Certification: Exness adheres to international standards through regular checks and certifications, ensuring its operations remain fully compliant with global regulations.

Tips for Hassle-Free Payments on Exness

To avoid issues when depositing or withdrawing funds from your account, follow these practical tips:

- Use the Same Payment Method:

Always try to use the same payment method for both deposits and withdrawals. - Verify Your Account:

Ensure your account is fully verified and follow the necessary verification steps to enable seamless transactions. - Monitor Your Account Balance:

Regularly check your account balance in your personal area to stay aware of your funds. This helps you know when to top up or ensure you have enough for a withdrawal. - Double-Check Payment Details:

Always verify your payment details before making any transaction. - Contact Customer Support:

For any unclear situations or issues, don’t hesitate to reach out to Exness customer support for assistance.

Conclusion

By partnering with Exness, you gain 24/7 support and the ability to buy, trade, or sell assets anytime, helping you grow your capital. Exness provides convenient transaction terms, a variety of payment systems for funding your trading account, and fast withdrawals. The deposit and withdrawal process is simple, quick, and secure, with no commission fees charged by the broker—a rare benefit in the trading industry. Exness ensures high-quality service and instant execution of all requests.

FAQ: Deposits and Withdrawals with Exness

What payment methods does Exness support?

Exness supports a variety of payment methods, including bank cards, e-wallets like Skrill and Neteller, and bank transfers, depending on your region.