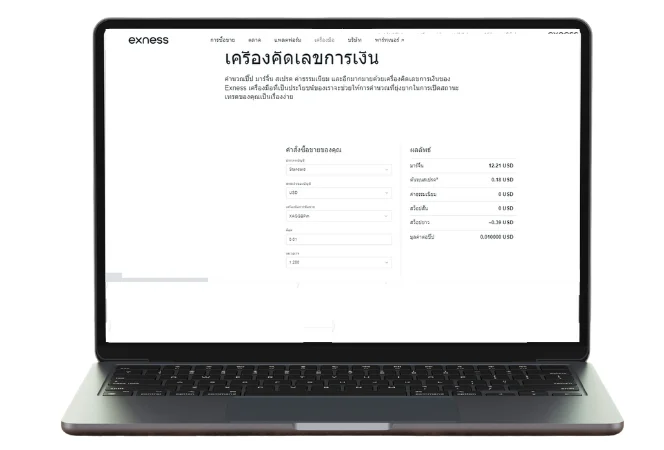

Why Use the Exness Calculator?

The Exness Trading Calculator is an essential tool for traders, designed to perform important calculations before making transactions. It helps calculate margin, pip value, and potential profit or loss, simplifying your trade planning.

Using the Exness calculator is a smart choice for any trader. It saves time and provides accurate calculations, which can significantly reduce the risks associated with trading. This tool ensures you have a clear understanding of the financial aspects of your trades, helping you make more informed decisions.

Key Features of the Exness Trading Calculator

The Exness Trading Calculator offers several useful features that can enhance your trading experience. Here are some of its key features:

- Multiple Calculation Parameters:

The calculator takes various factors into account, such as account type, trading instruments, lot size, and leverage, to deliver precise results. - User-Friendly Interface:

The interface is designed to be simple and intuitive, making it accessible for both beginners and experienced traders. - Instant Results:

You’ll receive instant calculations, including potential profit, required margin, pip value, and swap rates. - Risk Management:

The calculator helps you assess the risk of each transaction, allowing you to plan trades with minimal losses. - Customizable Inputs:

Users can customize input data according to their trading style and preferences, making it a flexible tool for various strategies.

Calculation Parameters

To get accurate results from the Exness Trading Calculator, it’s important to understand the parameters involved. Here are the main ones:

- Account Type:

Each Exness account type has different conditions, and knowing your account type helps with accurate calculations. - Instrument:

This refers to the asset you’re trading, such as currency pairs, commodities, or indices. - Lot Size:

The size of your trade, which directly impacts your margin and potential profit or loss. - Leverage:

Leverage indicates how much you’re borrowing to trade. Higher leverage increases potential profits but also amplifies risk. - Buy and Sell Prices:

These are the prices at which you can buy or sell the instrument you’re trading, and they affect your calculations for profit and margin.

How to Use the Exness Calculator

Using the Exness Trading Calculator is straightforward and can help you make well-informed trading decisions. Here’s a step-by-step guide to using it effectively:

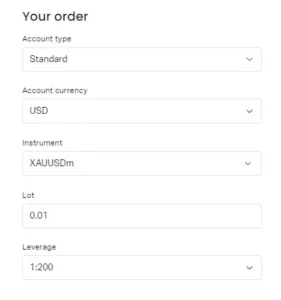

Selecting the Account Type

Start by choosing your account type. Exness offers several account options, including Standard, Pro, Raw Spread, and Zero. Each account type has different trading conditions, such as spreads and commissions, so it’s essential to choose the correct account type to ensure accurate results. For example, if you’re using a Raw Spread account, select this option in the calculator to reflect the actual trading conditions.

Choosing the Instrument and Lot Size

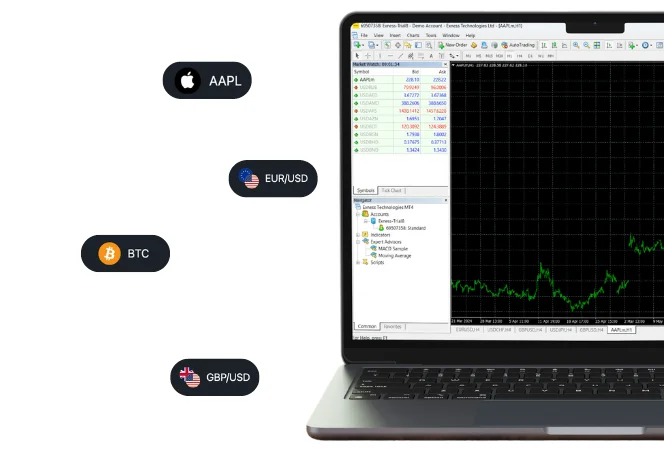

Next, select the trading instrument and input the lot size. The Exness calculator supports various trading instruments, including:

- Currency pairs (e.g., EUR/USD)

- Metals (e.g., XAU/USD for gold)

- Cryptocurrencies (e.g., BTC/USD for Bitcoin)

Once you’ve chosen the instrument, input the lot size you plan to trade. For instance, if you plan to trade 0.5 lots of XAU/USD, enter “0.5” in the lot size field.

Leverage Settings

The leverage you choose significantly impacts your trading results. You can specify the leverage you’re using for your trading account. For example, if your account is set to 1:200 leverage, enter this value in the leverage field. The leverage level determines the required margin for your trades and directly affects the potential profit or loss.

Calculating the Results

Once you’ve entered all the necessary data, click on “Calculate” to receive the results. The calculator will provide important figures such as. The amount of money needed to open the trade. The amount you gain or lose for every pip movement in the market. Based on the inputs, the tool will show the possible outcome of your trade.

For example, if you’re trading 1 lot of EUR/USD with 1:200 leverage, the required margin might show as $500. The calculator will also display the pip value, showing you how much money you can gain or lose for each 1 pip movement.

Tips for Accurate Calculation

To get the most out of the Exness Trading Calculator, follow these guidelines:

- Verify Input Data: Before pressing Enter, double-check that you’ve entered the correct account type, instrument, lot size, and leverage. Even small errors can lead to incorrect results, which may affect your trading decisions.

- Use Real-Time Market Prices: Ensure you’re using current market prices for your calculations. The market can be volatile, so using up-to-date information is crucial for accuracy.

- Understand Your Parameters: Know what each parameter (e.g., leverage, lot size) means and how it influences the outcome. This understanding helps you make more informed trading decisions.

- Enter Relevant Numbers: Input numbers that align with your trading strategy and goals. Avoid using extreme values that don’t match your trading plan, as this could lead to unrealistic expectations.

- Analyze Your Results: Carefully review the results, including potential profit, margin, and other key metrics. Ensure that they match your expectations and strategy before proceeding with the trade.

Understanding Results from the Exness Calculator

When using the Exness calculator, you will receive important information about your trades. Here’s a brief guide to understanding the results:

Margin

Margin is the initial amount of money required for a trade. It represents a small fraction of the total trade size. The calculator determines the margin needed based on your account type, lot size, and leverage, helping you understand how much money you need to set aside for the trade.

Spread Cost

The spread cost is the difference between the buy and sell price of a specific trading instrument. It’s essentially a trading fee applied to each trade. The calculator shows how much the spread cost is for your chosen trade.

Commission

A commission is a fee that the broker may charge for each trade. The Exness calculator will indicate if there’s a commission and the rate. This helps you calculate the overall cost of your trade.

Swaps (Long and Short)

Swaps refer to interest charges when holding a trade overnight. A long swap applies to buy positions, while a short swap applies to sell positions. The swap rates (either a cost or income) are displayed in the calculator, showing what you’ll pay or earn for holding a trade overnight.

Pip Value

The pip value represents the amount of money you gain or lose for each movement of one pip in the market. The calculator will determine the pip value based on your lot size and trading instrument, helping you estimate potential profit or loss for each price movement.

Using the Exness Trade Calculator for Risk Management

The Exness Trade Calculator is an excellent tool for managing trading risks, allowing you to see potential outcomes before executing a trade. Here’s how it helps:

- Plan Your Trades: The calculator lets you experiment with different settings to see how changes in parameters affect your trade. This helps you plan more effectively.

- Set Stop Loss and Take Profit: The tool allows you to configure the best Stop-Loss (to minimize losses) and Take-Profit (to lock in profits) levels, ensuring your funds are protected.

- Understand Your Risk/Reward: By calculating potential risks and rewards, the tool helps you decide whether to proceed with a trade. This leads to more informed and safer trading decisions.

Comparing Different Trading Scenarios

Knowing how specific trading conditions affect your profit or loss is crucial for decision-making. The Exness Calculator helps you simulate various scenarios to make the best choices.

Let’s consider trading the EUR/USD currency pair with different leverage and lot sizes:

| Parameter | Scenario 1 | Scenario 2 |

|---|---|---|

| Instrument | EUR/USD | EUR/USD |

| Lot Size | 1 Lot | 0.5 Lot |

| Leverage | 1:100 | 1:500 |

| Account Type | Standard | Pro |

| Required Margin | $1,000 | $100 |

| Pip Value | $10 per pip | $5 per pip |

| Potential Profit/Loss | $100 for 10 pip movement | $50 for 10 pip movement |

This comparison shows how different lot sizes, leverage, and account types affect the required margin, pip value, and profit or loss. By using the Exness Calculator, you can evaluate various trading setups, helping you make the best decisions for your strategy.

Scenario Analysis

You are trading 1 lot of EUR/USD with 1:100 leverage on a Standard account. The required margin for this trade is $1,000, and each pip movement is worth $10. This means for a 10-pip market movement, your profit or loss will be $100.

You are trading 0.5 lots of EUR/USD with higher 1:500 leverage on a Pro account. Here, the required margin drops to $100, and each pip movement is worth $5. So, for the same 10-pip market movement, your profit or loss would be $50.

Comparing Results

These two scenarios highlight how leverage and lot size can affect your trades. Higher leverage results in lower margin requirements, while smaller lot sizes lead to reduced profits, but also lower risk. Adjusting these parameters allows you to balance between maximizing potential gains and managing risk effectively.

Frequently asked questions about Exness Calculator

How to Calculate Margin Using the Exness Calculator?

To calculate margin, select your account type, trading instrument (e.g., EUR/USD), lot size, and leverage level in the Exness Calculator. The tool will instantly display the required margin, which is the minimum amount of capital needed to open the trade.