What does Exness Minimum Deposit Amount Mean?

Exness is a leading international broker, trusted by traders across all experience levels. This reputation is built on offering trading conditions that align with traders’ needs, boosting profit potential while avoiding strict deposit limitations. If a minimum deposit is required, traders are expected to deposit at least the specified amount.

As a fully licensed and regulated broker, Exness adheres to legal standards, including specific requirements for client deposits. The minimum deposit varies depending on the type of trading account. For example, a standard account may require a minimum deposit of just $1, depending on the payment method, while a professional account typically starts at $200.

Minimum Deposit for Exness Account Types

On the Exness platform, you can choose from several account types, including demo accounts that require no deposit. However, when it comes to real trading, Exness offers two main account types: Standard and Professional.

- Standard Account: Ideal for all traders, especially beginners. It features no commissions, unlimited leverage, and essential tools. The minimum deposit depends on the payment method, starting at $1 or $10. With this account, you can trade currencies, cryptocurrencies, indices, stocks, metals, and energies. Spreads start as low as $0.3, making it perfect for micro-lot trading.

- Professional Account: Designed for experienced traders who handle large volumes and are willing to take higher risks for greater rewards. There are three options: Pro, Zero, and Raw Spread. Each requires a minimum deposit of $200. Available instruments include metals, energies, cryptocurrencies, indices, stocks, and forex. Leverage is unlimited, with spreads starting at $1 for Pro and zero for Raw Spread and Zero Spread accounts.

Benefits of a Low Minimum Deposit

A lower minimum deposit offers several key advantages for traders:

- Lower Risk: Reduces the chance of significant financial loss if a trade doesn’t go as planned.

- No Deposit Fees: Exness does not charge fees for deposits, making it cost-effective for traders.

- Secure Accounts: Exness uses advanced encryption to protect your trading account and funds.

- Separate Client Funds: Your money is kept separate from the broker’s funds, ensuring its safety.

- Free Trading Tools: A small deposit gives access to free tools, allowing traders to test strategies without a big investment.

- Great for Beginners: New traders can start learning and practicing with minimal financial commitment.

- Potential Success: Even with a small deposit, successful trading is possible if you use the broker’s tools and conditions wisely.

How to Fund Your Exness Trading Account?

Exness offers multiple ways to fund your account without charging deposit fees, though payment providers may have their own charges. Deposits can be made 24/7, and funds typically reflect in your account within minutes to 24 hours. The platform accepts both major and minor currencies, but it’s essential to consider the region of your account registration and account type. Currency conversion fees might apply if the deposit currency differs from your account’s base currency.

Bank Transfer Deposits

Exness allows bank transfers, typically processed within 30 minutes. After registering and verifying your account, follow these steps to deposit funds:

- Log in to Exness and select “Deposit” from the left-hand toolbar.

- Open the deposit form and choose “Bank Transfer” as your payment method.

- Enter the deposit amount, currency, and account number.

- Click “Next” to be redirected to the payment provider’s website.

- Confirm the transaction to complete the process.

Funds will be transferred to your trading account, and you’ll receive a confirmation email once the process is complete.

Credit/Debit Card Deposits

You can also fund your account using a credit or debit card with instant registration. Follow these steps:

- Log in to your Exness account and select “Deposit” from the toolbar.

- Choose “Credit/Debit Card” as your payment method.

- Enter the amount and card details.

- Click “Top Up” to proceed.

- You’ll be redirected to the payment system’s website to select the card-issuing bank.

- Confirm the transfer to complete the deposit.

After the payment is processed, the funds will be available in your trading account.

Depositing Funds with Electronic Payment Systems

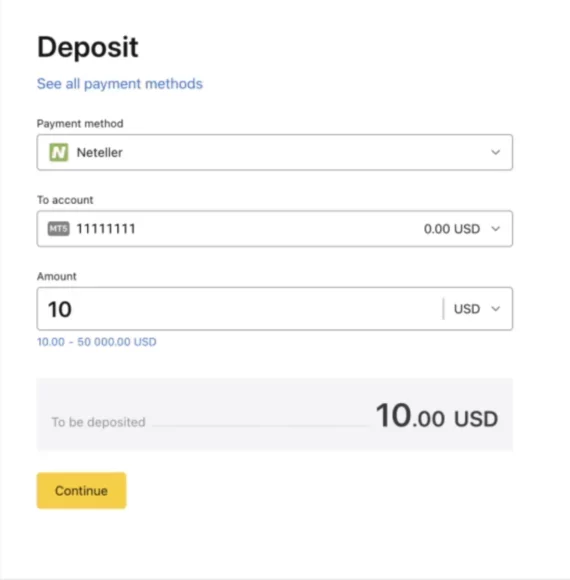

Traders can easily fund their Exness trading accounts using electronic wallets like Skrill, Neteller, and others. This method is known for its reliability and convenience. Follow these steps to deposit funds:

- Log in to your account using your username and password.

- Choose “Deposit” from the menu.

- In the “Fund Your Account” section, click on the electronic payment system you want to use.

- Enter the required payment details: currency, amount, and electronic wallet information.

- Complete the transaction through the payment system’s website.

You can check the status of your current transaction and review your payment history in your personal account page.

Key Conditions for Traders on Exness

To ensure smooth transactions on Exness, traders should follow these essential steps:

- Provide Accurate Information: Always use up-to-date and correct details.

- Double-Check Details: Carefully enter and review all information to avoid errors.

- Verify Your Identity: Confirm your identity before making payments to speed up processing times.

- Choose Supported Payment Methods: Use payment processors that are registered and compatible with both your region and the Exness platform.

- Evaluate Payment System Factors: Consider the speed of deposit processing, commission fees, and spreads when selecting a payment system.

Exness Deposit Processing Time

Deposits at Exness typically take about 30 minutes to process and approve. However, the actual time can vary depending on the payment method. Bank transfers may take up to five business days, while electronic wallets and bank cards generally avoid such delays.

Spreads and Commissions

Exness does not charge any deposit fees, regardless of the account type. If transaction fees are applied, they are imposed by the payment provider. The account type also influences the spread size. For Standard accounts, spreads start at 0.3 pips, while Professional accounts offer spreads as low as 0 or 0.1 pips.

FAQ: Exness Minimum Deposit

What is the minimum deposit required to open an account with Exness?

The minimum deposit to open an account with Exness varies depending on the type of account. For a Standard account, the minimum deposit can be as low as $1 or $10, depending on the payment method. For Professional accounts, the minimum deposit starts at $200.