OANDA is one of the most established and respected names in the global forex and CFD industry, known for its pricing transparency, institutional-grade data, and advanced trading tools. Founded in 1996, OANDA has built a strong reputation among both retail and professional traders through its focus on honest pricing, robust execution, and superior research capabilities.

For traders in Thailand, OANDA provides an ideal balance between accessibility and sophistication. It supports a wide range of instruments — from forex and indices to commodities and metals — and integrates premium analytics, risk management tools, and algorithmic trading capabilities. The broker’s clean design, accurate data, and reliable order execution make it a trusted choice for both short-term traders and long-term investors.

Key Advantages of OANDA for Thai Traders

1. Transparent Pricing and Competitive Spreads

OANDA’s core strength lies in its clarity and fairness in pricing. The broker provides competitive spreads across major currency pairs and offers a clear commission-based model for traders who prefer raw pricing structures. Thai traders appreciate that OANDA publishes live and historical spread data, making it easy to verify costs and execution quality.

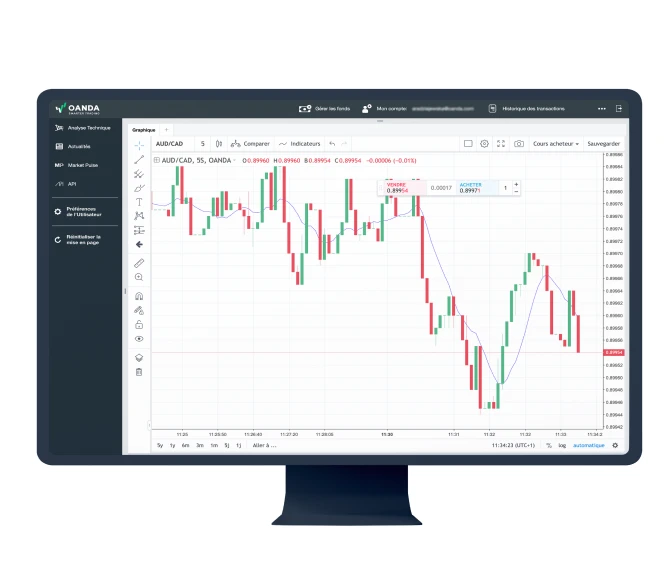

2. Advanced Trading Platforms (MT4 and Proprietary Interfaces)

OANDA supports the world’s leading trading platform, MetaTrader 4 (MT4), alongside its own proprietary web and mobile platforms:

- OANDA Web Trader: Browser-based interface with a smooth design, fast execution, and real-time analytics.

- OANDA Mobile App: Fully functional trading app with built-in charts, alerts, and portfolio tracking.

- MetaTrader 4 (MT4): For traders who rely on automated Expert Advisors (EAs) and advanced order management.

These platforms are equipped with premium charting packages, depth-of-market data, and one-click trading, allowing Thai traders to react quickly in volatile conditions.

3. Deep Research and Market Insights

OANDA offers exceptional research resources and analytics, supported by decades of market data and expertise. Traders gain access to:

- Historical data and backtesting tools.

- MarketPulse™, OANDA’s in-house news and analysis portal.

- Technical and fundamental insights from industry experts.

- Premium economic calendar and live sentiment indicators.

For Thai traders, this level of research and transparency helps in developing disciplined, data-backed strategies.

Account Types and Trading Condition

OANDA keeps its account structure simple and transparent, making it easy for Thai traders to start with the right setup:

| Account Type | Minimum Deposit | Spreads | Commission | Platforms | Leverage |

|---|---|---|---|---|---|

| Standard Account | $0 | From 0.8 pips | None | MT4, Web, Mobile | Up to 1:200 |

| Core Account | $500 | From 0.0 pips | $5 per lot | MT4, Web | Up to 1:200 |

Both account types feature:

- Tight spreads and fast execution

- No dealing desk intervention

- Negative balance protection

- Access to premium analytics and historical data

OANDA’s execution engine handles thousands of orders per second, providing stable performance even during news-driven volatility.

Regulation and Security

OANDA operates under strict global regulation, ensuring safety and compliance for traders across all regions, including Thailand.

Regulatory Authorities:

- FCA (UK) — Financial Conduct Authority

- ASIC (Australia) — Australian Securities and Investments Commission

- IIROC (Canada) — Investment Industry Regulatory Organization of Canada

- MAS (Singapore) — Monetary Authority of Singapore

- CFTC/NFA (USA) — Commodity Futures Trading Commission / National Futures Association

These licenses guarantee segregated client funds, transparent pricing audits, and compliance with the highest industry standards.

Trading Instruments Available

OANDA provides access to a diverse portfolio of global markets, enabling Thai traders to build multi-asset strategies:

- Forex: Over 70 major, minor, and exotic pairs.

- Commodities: Gold, silver, oil, and natural gas.

- Indices: Global benchmarks such as NASDAQ, FTSE 100, and Nikkei 225.

- Metals: Precious metals for safe-haven trading.

- Bonds: Select government bonds and yield instruments.

This wide coverage allows Thai traders to diversify portfolios and hedge risk effectively across global markets.

API Trading and Advanced Infrastructure

OANDA is one of the few brokers offering robust API access for traders and developers who rely on algorithmic or quantitative trading.

Key advantages include:

- REST and FIX APIs for custom automation.

- Low-latency connectivity for faster data feeds.

- Access to historical and live tick data for backtesting.

- Integration with third-party analytics tools such as TradingView.

This professional-grade infrastructure makes OANDA a preferred broker for systematic and high-frequency traders in Thailand.

Funding and Withdrawals for Thai Clients

OANDA supports straightforward and secure payment methods for Thai traders, including:

- Local bank transfers (via major Thai banks)

- Credit/Debit cards (Visa, MasterCard)

- E-wallets (Skrill, Neteller)

- Wire transfers

Funding and withdrawals are processed quickly, usually within one business day, and OANDA maintains full transparency on transaction fees. Thai clients appreciate the broker’s clear funding routes and reliable local payment options.

Education and Client Support

OANDA provides extensive educational resources and customer service designed to help traders progress at every stage.

Key learning tools include:

- Webinars and video tutorials led by trading professionals.

- In-depth guides on risk management and strategy building.

- Trading basics and platform walkthroughs for beginners.

- MarketPulse™ blog with daily insights and technical breakdowns.

Customer support is available 24/5 via live chat, phone, and email, with Thai-friendly assistance and prompt response times.